A financial coach can help you see your finances from a new perspective. A finance coach can help you see the bigger picture and guide you.

Behavioral finance

Behavioral finance is an emerging field that is becoming more popular in the investment world. It focuses on the principles and connections between behavior and goals. A behavioral finance coach, a financial adviser who is trained in this area of study, is called a behavioral finance expert. These coaches can help you communicate with clients and prospects in more engaging ways. The key to behavioral finance is understanding how to present your messages correctly. By understanding how clients process information, you can craft more effective messaging that takes into account their emotions.

Behavioral finance helps people make better financial choices. It aims to understand the reasons why people make certain decisions and what influences those decisions. It also discusses our unconscious biases and financial market tendencies. These concepts can be used to help individuals make better financial decisions which will in turn affect the economy.

Personal financial coaching

Individual financial coaching can help people reach their financial goals, and improve their financial health. A coach can assess your spending habits, and recommend new ways to track income. They can also serve as accountability partners, helping clients recover from debt and become more financially secure. Sometimes, coaches can also help clients with financial education and planning to save for their major financial goals.

A financial coach can help you create a budget, reduce your debt, set aside money for emergencies, and even plan for retirement. They typically meet with clients once a week, or every other week, for six months to one year. They can teach you how to manage your money, and help you save for the long-term.

Financial advisor versus personal financial coach

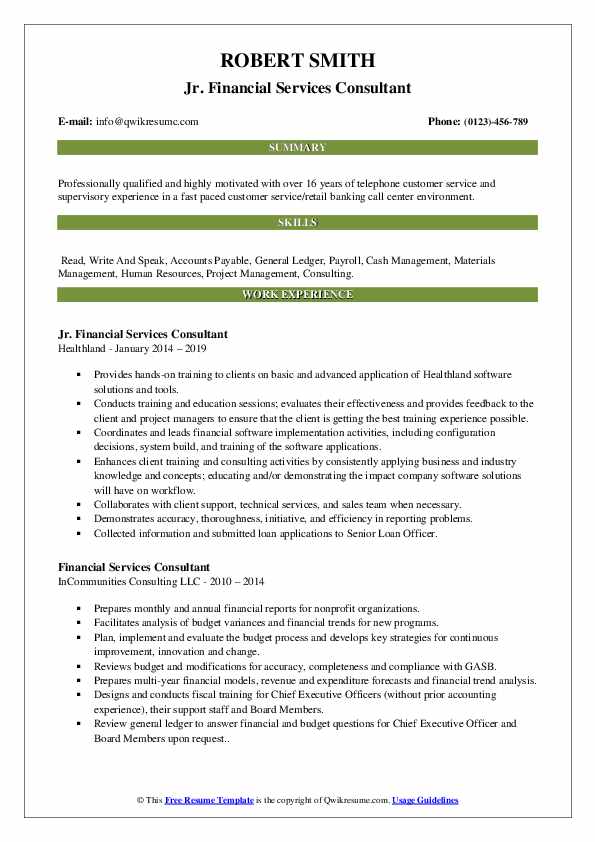

Financial advisors help clients achieve their financial goals by focusing on long-term planning. Clients often have personal financial coaches who meet with them before meeting with advisors and help them make financial decisions. They might assist clients in tax planning and estate planning. Some financial coaches provide ongoing portfolio analysis and advice.

A financial coach must have a strong sales background in order to attract new clients. They can promote themselves via traditional advertising and social networks. They must also establish their credibility through hosting seminars and being quoted in financial publications. In addition, a financial coach must be a good people person.

The cost of hiring a financial advisor

It is an excellent way to improve your finances, but it can be expensive. Coaching sessions can cost between $200-$2,000 per month and last for three to 5 sessions. A financial coach can help you save a lot of money and time.

Many small business owners struggle to manage cash flow and pay expenses. While this can lead to a high level of bank balance, it may also signal that your business has stopped growing. A financial coach is able to help you cut costs, make savings, and keep your company afloat. Schumm helped a couple with $45,000 worth of debt to reduce their monthly expenses and increase their revenue from $250,000 up to $350,000 over a year.

FAQ

What are the benefits of being a consultant

Consultants often have the option to choose when and what they do.

This means that you can work when you want and wherever you want.

This allows you to easily change your mind and not worry about losing your money.

Finally, you can control your income and set your own schedule.

How much does it take to hire a consultant

There are many factors that influence the price of consulting services. These are:

-

Project size

-

Time frame

-

Scope of work

-

Fees

-

Deliverables

-

Other factors to consider include location, experience, and other considerations.

What is the difference of a consultant versus an advisor?

An advisor gives information on a topic. A consultant can offer solutions.

Consultants work directly for clients to help achieve their goals. Clients are referred to advisors through books, magazines and lectures.

Statistics

- Over 50% of consultants get their first consulting client through a referral from their network. (consultingsuccess.com)

- On average, your program increases the sales team's performance by 33%. (consultingsuccess.com)

- My 10 years of experience and 6-step program have helped over 20 clients boost their sales by an average of 33% in 6 months. (consultingsuccess.com)

- 67% of consultants start their consulting businesses after quitting their jobs, while 33% start while they're still at their jobs. (consultingsuccess.com)

- Over 62% of consultants were dissatisfied with their former jobs before starting their consulting business. (consultingsuccess.com)

External Links

How To

How To Find The Best Consultant?

Ask yourself what you want from your new consultant before you start looking. Before you begin looking for a consultant, it is important to know what your expectations are. Make a list of everything you think you might need from a consultant. These could include professional expertise, technical skills and project management abilities, communication skills, availability, and other things. You might also want to talk with colleagues or friends about their recommendations. Ask them what their experience with consultants was like and how they compare to yours. Research online if you don’t already have recommendations. You will find many websites such as LinkedIn, Facebook Angie's List, Indeed and Indeed where people can leave reviews about their past work experiences. You can use the comments and ratings left by others to help you find potential candidates. Once you have narrowed down your list, reach out to potential candidates and set up an interview. During the interview, you should talk through your requirements and ask them to explain how they can help you achieve those goals. It doesn't really matter if they were recommended; as long as they understand your business objectives, they will be able to show how they could help you achieve them.